Australia Backs Cambodia's Government-Private Sector Forum

Phnom Penh, August 21, 2023 --Australia has expressed its support for Cambodia's Government-Private Sector Forum (G-PSF), the peak platform for dialogue between the government and private sector in Cambodia.According to a recent news release of the Australian Embassy in Phnom Penh, Australia is supporting the inclusive development of a strong private sector in Cambodia - a vibrant private sector is essential for promoting inclusive economic growth and poverty reduction.Through the Cambodia Australia Partnership for Resilient Economic Development (CAPRED), Australia is working with Cambodia Chamber of Commerce, the Council for the Development of Cambodia and other stakeholders to improve the effectiveness of the G-PSF, it added.Recent discussions between Australia, CAPRED and the CCC have focused on ways to improve the G-PSF to make it inclusive and results oriented, said the same source, pointing out that in particular, support will be provided to strengthen the 14 technical Working Groups at the national level and support public and private sector dialogue at the provincial levels.By facilitating the input from Cambodia’s private sector, it underlined, the G-PSF's history indicates that it can contribute to improving the enabling environment for businesses in Cambodia. The impact of this work can stimulate economic growth and increase opportunities, generating jobs and reducing poverty.

Indonesia to Import Cambodian Rice and Export Fertilisers to Cambodia

Phnom Penh, August 17, 2023 --In recognising the importance of food security for the two countries and the region, Indonesia expressed its intention to import rice from Cambodia and export fertilisers to Cambodia through both government-to-government and business-to-business agreement frameworks.The intention was raised by H.E. Pahala Nugraha Mansury, Vice Minister of Foreign Affairs of the Republic of Indonesia, during a meeting here on Aug. 15 with H.E. Dr. Soeung Rathchavy, Secretary of State at the Ministry of Foreign Affairs and International Cooperation (MFAIC).According to an MFAIC’s press release, the two sides expressed satisfaction on the progress in bilateral relations which have grown from strength to strength in multifaceted areas and agreed to further enhance cooperation in key areas including political-security, trade, tourism, education, health and agriculture.The Cambodian side expressed high appreciation to Indonesia for its assistance in human resource development and welcomed Indonesia’s willingness to provide capacity building in the area related to agriculture such as irrigation system management and fisheries, including aquaculture.H.E. Pahala Nugraha Mansury warmly congratulated Cambodia on the success of the General Election and expressed full support of the Indonesian Government to continue working closely with the Royal Government of Cambodia under the new mandate.Both sides also discussed the preparations for the upcoming Meeting between H.E. Kitti Tesaphibal Bindit Hun Manet, incoming Prime Minister of the Kingdom of Cambodia, and President Joko Widodo on the sidelines of the 43rd ASEAN Summit and Related Summits in Jakarta and the 5th Joint Commission for Bilateral Cooperation (JCBC) between Cambodia and Indonesia in the fourth quarter of 2023.

Preah Sihanouk, Thai Delegation Discuss Investment Potential

Phnom Penh, August 18, 2023–Preah Sihanouk Provincial Administration has received a delegation from the Thai Enterprise Development Division to discuss investment potential in the province. Deputy Governor of Preah Sihanouk province, Mr. Long Dimanche, accompanied by representatives of tourism associations, agencies, and entrepreneurs associations, met the Thai delegation led by Mr. Audsitti Sroithong on Aug. 17 As highlighted by the deputy governor, Preah Sihanouk province has beautiful beaches, 32 tourism islands, and is rich in ocean resources. The province's deep-sea port, which is 9.5 metres deep, is a gateway for about 70 percent of goods importing into and exporting from Cambodia. He added that the depth of the port will be increased to 14.5 metres by 2030 and then to 17.5 metres to accommodate larger transport vessels. The province, he continued, is also home to special economic zones of goods stockpiled for regional distribution and some 170 factories operating. To make Preah Sihanouk province a multi-purpose economic zone, the Royal Government of Cambodia is expanding the province's airport, and the city is also connected by railway and highway to Phnom Penh capital, and other provinces. Preah Sihanouk province has been cooperating well with the provinces of Trat and Chanthaburi in Thailand. Mr. Audsitti Sroithong appreciated the briefing and spoke highly of Preah Sihanouk's rapid development, and he was very optimistic about Thailand's investments in the province in the near future. He also proposed the establishment of an investment coordination mechanism between the province and the Thai Chamber of Commerce.

Cambodia Investing Heavily in Tourism Skill Training

Phnom Penh, August 17, 2023 -- Cambodia is a leading country in ASEAN investing heavily in tourism skill training for youth, according to an assessment of the Economic Research Institute for ASEAN and East Asia (ERIA).The note was highlighted in a recapitulative meeting of the National Committee for Tourism Professionals (NCTP) of the Ministry of Tourism, chaired by H.E. Thong Khon, Minister of Tourism here in Phnom Penh on Aug. 14. H.E. Thong Khon said the NCTP's achievements in training tourism skills to youth in accordance to the national and ASEAN mechanisms such as study curriculum development, teacher training, and tourism study mainstreaming at general high schools and technical education.The minister encouraged the involved experts to manage the training well, especially for the skills of spa-massage, chef and MICE (Meeting, Incentive, Convention, Exhibition) with certificates acknowledged by ASEAN. Since 2011, Cambodia has carried out capacity assessment of tourism professionals and provided needful training in line with the national and ASEAN qualification framework, said H.E. Try Chhiv, Chairman of NCTP Secretariat.

25 Chinese Firms to Invest in Kampong Speu

Phnom Penh, August 16, 2023 --Twenty-five (25) Chinese factories and enterprises will invest in Cambodia's Kampong Speu province this year.The good news was shared by H.E. Vey Samnang, Governor of Kampong Speu province, while leading a delegation to inspect the production chains of factories and entrepreneurs in Guangzhou province, the People's Republic of China, on Aug. 14.Of the 25 plants, two belonging to SITOY Group will produce world-brand bags and are expected to generate 3,000 jobs, and six garment factories from Hong Yi Industrial Park are expected to create 6,000 jobs.Other 17 garment, textile, shoe, electronic component, phone cases and screens, and dyeing fabric factories from Suzhou Industrial Park are expected to generate 14,000 jobs.In the first step, those factories and enterprises will create a total of 23,000 jobs for the locals by the end of 2023.

Lucrative Local Bamboo Business

Phnom Penh, August 15, 2023 --A Siem Reap man has modernised the design of household materials and souvenirs made of bamboo, making it a lucrative business in the province.A resident of Thnal Bandoy village, Preah Dak commune, Banteay Srei district in Siem Reap province, Mr. Sreng Sreb said he has spent almost 13 years upgrading his family bamboo business, passed on to him by his parents. Though it takes at least six months to process fresh bamboo into various materials, the current market price for them is very decent, he said.He added that "Bamboo hammock is currently a bestseller at his place, and I can make at least US$60 from a bamboo hammock."According to Mr. Sreb, the best bamboos that can produce quality household materials and souvenirs are those with low sugar, are big enough, and are resistant to heat and water.He bought those bamboos from other villagers in Siem Reap, so when his business is going well, those villagers also benefit from it.The success of Mr. Sreb's business is attracting many locals to grow bamboo, and the extra farming is contributing significantly to their families' livelihoods.Looking to the future, Mr. Sreb wants to expand his tailored supplies for home, restaurant, and hotel designs and export his products to international markets.He also encouraged more supporters for products made of bamboo, which do not deplete the forest but promote it and create jobs.

STMarket Hosted a Successful Workshop on Alternative Investment and CFDs

Phnom Penh, August 12, 2023 --Phnom Penh, Cambodia, August 8, 2023 - STMarket, a leading broker in Cambodia and regulated by the Securities and Exchange Regulator of Cambodia (SERC), hosted a successful workshop on alternative investment and CFDs on August 5, 2023, from 9:00 a.m. to 12:00 p.m. The event took place at the STMarket office at Amass Central Tower, 23rd floor.The workshop was attended by more than 50 participants who were interested in learning more about alternative investment and CFDs trading. The workshop covered topics such as how to earn passive income by trading CFDs, guides to fundamental analysis, and guides to technical analysis which was conducted by Mr. Bean Ratana, a technical analyst and trainer with over 7 years of experience in the FX industry.This workshop provided tips and tricks from experts in the industry, and also free food, drinks, and networking opportunity to participants.“We are very pleased with the outcome of the workshop. We received positive feedback from the participants who said they learned a lot from the workshop and enjoyed the interactive and engaging atmosphere. We hope that the workshop will help them to make informed and profitable decisions in the CFDs market. We also hope that the workshop will increase their trust and confidence in our products and services.” said Mr. Ros Rithpanha, the Business Growth Specialist of STMarket.Representing the STMarket business team, we would like to extend our sincere gratitude and thanks to our esteemed media partners, The KhmerToday, for their invaluable contribution to our workshop. Your involvement has played a significant role in disseminating knowledge about investment education and has been instrumental in achieving our awareness objectives.STMarket provides diversified products including Forex product, Commodities, Stock and CFDs, we also aim to serves our clients with a secure, transparent, and user-friendly trading environment, as well as excellent customer service and support. Therefore, we plan to host more workshops in the future to provide trading education to the public and increase their awareness and confidence in financial products investment. For more information, please visit stmarket.com.kh or follow STMarket page on Facebook.What you should not miss out on? Get in touch with us through the Real estate expo this Saturday, August 12th-13th, 2023 to know more about our company and your investment journey. Come and visit us now!

Non-Sovereign Loan Forum Guides Private Sector to Directly Access Development Partners’ Financial Services

Phnom Penh, August 09, 2023 --The Ministry of Economy and Finance has held a forum on non-sovereign loan aimed at providing directions and guides to private sector and business associations to access loan directly from the international financial institutions.The half-day forum took place in Phnom Penh on Aug. 9 under the presidency of H.E. Hem Vanndy, Secretary of State at the Ministry of Economy and Finance, Mr. Anthony Gill, Principal Portfolio Management Specialist of the Asian Development Bank, Ms. Sandrine Boucher, AFD’s Country Director, Mr. Dourng Kakada, Operation Officer of the International Finance Corporation, and selected business associations who are active and key to the private sector development.The forum provided clarity on the comparative advantage of each financing institution, financing mechanisms and requirements of each financing institution, and opportunities and challenges in private sector financing in Cambodia.The forum was organised to collect feedback and the voices of the private sector who are on the ground in regards to their demand and their outlook of the sector development, and private sector and the abovementioned institutions will be able to report what they are in need, said H.E. Hem Vanndy. The ministry in cooperation with these institutions would formulate the medium-term Country Financing Framework for non-sovereign financing to guide and direct the investments in the priority sectors identified by the government and ensure that investments are allocated based on the comparative advantage of the institutions, he said.“The new innovations and modalities will help our country and people of businesses get a better relief after they were to march from Covid. They need goods from all of us,” he said.The private sector is now more than ever becoming increasingly important in order to help the government achieve the economic growth and development ambitions.The private sector is recognised as an indispensable partner of the government and its development remains the priority for the RGC in the market economy development approach and plays a key role in promoting growth and socio-economic development.

Cambodia’s Insurance Industry Records Premium of US$80 Million in Q2

Phnom Penh, August 10, 2023 --Cambodia’s insurance industry recorded a total premium of US$81.2 million in the second quarter (Q2) of 2023, up 6.3 percent from US$76.3 million in the same period last year, a report showed on Thursday.The growth was driven by 18 general insurers, 14 life insurers, seven micro-insurance companies, one reinsurance firm, and 20 insurance brokers, 34 corporate agents, and loss adjusters, it said.The gross premium of general insurance market during the April-June period this year was US$33.3 million, a year-on-year increase of 16.4 percent, while life insurance premium totaled US$46.1 million, down 0.13 percent, and micro-insurance premium was amounted to US$1.7 million, up 12.3 percent, the source added.The report pointed out that the total amount of claims paid out by the insurers was US$7.7 million in the cited period, up 27.5 percent from US$6 million a year earlier.According to the report, Cambodia’s insurance sector had US$1,050 million in total assets as of Q2 this year, a year-on-year increase of 10.8 percent.The increased insurance premiums have reflected the strength of the insurance market in the Kingdom, as the insurance sector contributed about 1.17 percent to the country’s gross domestic product (GDP) per year, according to the Insurance Regulator of Cambodia (IRC).The insurance density in the country is about US$20.53 per person, which indicates that the insurance sector will have a great potential for future development, it said.

DPM: Investors Will Benefit from Cambodia's Investment Potential

Phnom Penh, August 11, 2023 --Cambodia is positive that Chinese investors will benefit from the country's investment potential. Samdech Kittisangahapundit Men Sam An, Deputy Prime Minister and Minister of National Assembly-Senate Relations and Inspection, made the point when presiding over the inauguration of the Shunde Entrepreneur Association in Cambodia here in Phnom Penh on Aug. 9. Samdech Men Sam An welcomed the Chinese association and future investment in Cambodia to further boost bilateral trade under the Belt and Road initiative. She also underlined Cambodia's peace, political stability, rich natural resources, young work force, and supportive investment conditions favourable for investors.The event coincided with the 65th anniversary of diplomatic relations between Cambodia and China — a long-standing and blossoming cooperation in all sectors.

Non-Sovereign Loan Forum Guides Private Sector to Directly Access Development Partners’ Financial Services

Phnom Penh, August 09, 2023 --The Ministry of Economy and Finance has held a forum on non-sovereign loan aimed at providing directions and guides to private sector and business associations to access loan directly from the international financial institutions.The half-day forum took place in Phnom Penh on Aug. 9 under the presidency of H.E. Hem Vanndy, Secretary of State at the Ministry of Economy and Finance, Mr. Anthony Gill, Principal Portfolio Management Specialist of the Asian Development Bank, Ms. Sandrine Boucher, AFD’s Country Director, Mr. Dourng Kakada, Operation Officer of the International Finance Corporation, and selected business associations who are active and key to the private sector development.The forum provided clarity on the comparative advantage of each financing institution, financing mechanisms and requirements of each financing institution, and opportunities and challenges in private sector financing in Cambodia.The forum was organised to collect feedback and the voices of the private sector who are on the ground in regards to their demand and their outlook of the sector development, and private sector and the abovementioned institutions will be able to report what they are in need, said H.E. Hem Vanndy. The ministry in cooperation with these institutions would formulate the medium-term Country Financing Framework for non-sovereign financing to guide and direct the investments in the priority sectors identified by the government and ensure that investments are allocated based on the comparative advantage of the institutions, he said.“The new innovations and modalities will help our country and people of businesses get a better relief after they were to march from Covid. They need goods from all of us,” he said.The private sector is now more than ever becoming increasingly important in order to help the government achieve the economic growth and development ambitions.The private sector is recognised as an indispensable partner of the government and its development remains the priority for the RGC in the market economy development approach and plays a key role in promoting growth and socio-economic development.

Job Forum to Offer Some 741 Vacancies

Phnom Penh, August 09, 2023 --A job forum, scheduled for Aug. 10, 2023, is offering a total of 741 vacancies for potential youths and workers interested. Held from 08:00 to 17:00 at the Ministry of Labour and Vocational Training.The day-long fair is organised by the ministry’s National Employment Agency (NEA) in cooperation with different hiring agencies.Interested candidates can seek further details of the employment opportunities and file their application for the job they are interested in at the NEA.Key hiring agencies joining the job fair include Aeon Specialised Bank (Cambodia) Plc., Cambodia Airports, Macro Mall, CAB Bank, Kim Mix Construction and Investment Co., Ltd, Onion Mobility Co,. Ltd., Hattha Bank, Mekongnet, ZUT Home, Onion Mobility, GFG and InvestM. The forum, held every two weeks, is another solution made possible by the Royal Government of Cambodia to promote more job openings among Cambodians.

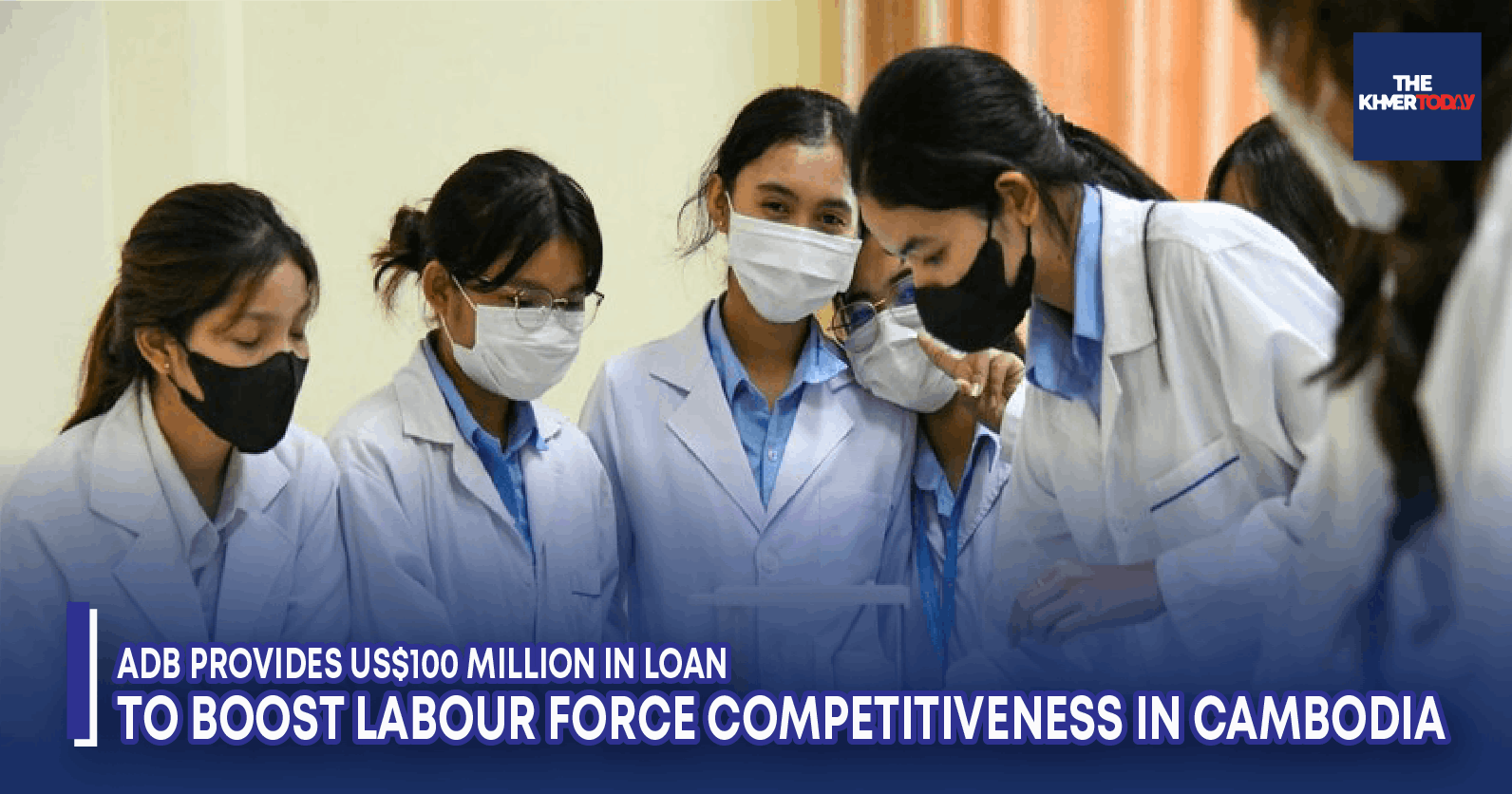

ADB Provides US$100 Million in Loan to Boost Labour Force Competitiveness in Cambodia

Phnom Penh, August 01, 2023 --The Asian Development Bank (ADB) has approved a US$100 million loan to help boost the caliber of Cambodia’s labour force by addressing skills gaps and shortages, said the bank in a news release this morning.This will be done through reforms and investments in technical and vocational education and training (TVET) combined with private sector participation, it pointed out.The first subprogramme of the Skills for Future Economy Sector Development Programme will help transform Cambodia into a technology-driven, knowledge-based industrial economy by strengthening its human capital resources, with a focus on enhancing the country’s skills development environment, providing industry-led inclusive training, and mobilising additional funds for demand-driven skills development, the source added.“Reshaping Cambodia’s labour force and modernising its economy requires the continual reform of the TVET system through comprehensive strategies and well-timed, successive investments,” said ADB Country Director for Cambodia Jyotsana Varma. “These structural and institutional reforms in TVET are crucial in designing training programmes that meet market demand, upgrade training facilities and equipment, and expand the Skills Development Fund (SDF).”According to the news release, the SDF was piloted by the government under the ADB-financed Skills for Competitiveness Project, which was approved in 2019 to boost the skills and competitiveness of Cambodia’s growing labour force. The SDF pilot has been responding to industry skills development training needs through cofinancing partnerships with government institutions, industries, training providers, and development partners.Three key challenges contribute to the broader constraints facing Cambodia’s TVET system: the lack of a focused and comprehensive skills development programme for the fourth industrial revolution, limited private sector roles in skills development and the transformational vision of industries, and inadequate financing and partnerships in skills development. Combined, these challenges limit the employability and productivity of current and future labour forces and may prevent post-pandemic Cambodia from diversifying and transforming into a knowledge-based economy. The Skills for Future Economy Program will help address these challenges.An estimated 9 million workers make up Cambodia’s labour market, with women accounting for 49 percent of the workforce. As of 2021, 54 percent of Cambodia’s population was under 30 years old, presenting a unique opportunity for the country to increase investment in human capital development and enhance the skills of new entrants to the labor market, while also upgrading the skills of existing workers to match industry demand.The programme is a key component of ADB’s support for the government to strengthen human resources and develop the private sector and jobs market. It is also aligned with the government’s overall development plan and strategy as well as ADB’s country partnership strategy for Cambodia, 2019-2023.

National Bank of Cambodia among Seven ASEAN Central Banks Working on Digital Currencies: BIS

Phnom Penh, August 03, 2023 --The Bank for International Settlements (BIS) says the National Bank of Cambodia is among seven Southeast Asian central banks involved in central bank digital currency (CBDC) development. In a report published Wednesday, the BIS said 93 percent of 86 central banks surveyed late last year were working on CBDC payment mechanisms. More than half were running concrete tests or working on pilots. The latest survey comes three years after former Bank of Japan Policy Board member Sayuri Shirai found that the National Bank of Cambodia was among three central banks leading the world in retail CBDC development.The others were the People's Bank of China and Sveriges Riksbank in Sweden. UNCERTAINTY FADING “Uncertainty about short-term issuance of a CBDC is fading,” the BIS report said. In addition to Cambodia, the survey found that central banks and monetary authorities in Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand are now “engaged in some form” of CBDC work.Among all central banks surveyed, work on retail CBDCs was more advanced than on wholesale CBDCs — with almost a quarter piloting a retail CBDC. “More than 80 percent of central banks see potential value in having both a retail CBDC and a fast payment system, mostly because a retail CBDC has specific properties and may offer additional features,” the report said. “The survey suggests that there could be 15 retail and nine wholesale CBDCs publicly circulating in 2030.” EMERGING MARKET AND DEVELOPING ECONOMIES ‘MORE ADVANCED’ THE BIS said 58 of the central banks surveyed were in emerging market and developing economy (EMDE) jurisdictions and 28 in advanced economies.EMDE central banks are “more advanced” in their CBDC work, the report said, noting that the four current “live” CBDCs have all been issued in EMDE jurisdictions — by central banks in the the Bahamas, Eastern Caribbean, Jamaica and Nigeria. Moreover, the share of EMDE central banks piloting CBDCs is almost twice as high as in advanced economies. MORE ISSUES EXPECTED OVER NEXT THREE YEARS The share of central banks likely to issue a retail CBDC within the next three years grew to 18 percent, up from 15 percent in the last survey in 2021. The likelihood of wholesale CBDC issues doubled from 8 percent to 16 percent over the same period.For retail CBDC issues, the survey found that motives among EMDE and advanced economy central banks were converging. “Domestic payments efficiency and payments safety have become nearly equally important as motivations in both,” the report said. Both “also attach about the same weight to the financial stability and cross-border payments efficiency reasons.” FINANCIAL INCLUSION MOTIVATIONS But there are two key differences — retail CBDC work in EMDE central banks is “more often driven by financial inclusion-related motivations” compared with central banks in advanced economies.EMDE central banks also “assign a higher weight to monetary policy implementation as a reason to explore or develop a CBDC.” As for stable coins and other crypto assets, the survey found that they are “rarely used for payments outside the crypto ecosystem.“Some 60 percent of surveyed central banks reported that they have stepped up their CBDC work in response to the emergence of crypto assets,” the report said. CRYPTO MARKET RISKS “The turbulence in the crypto market in 2022 and beginning of 2023 has shown that crypto assets pose risks when not properly designed and regulated. “Continued monitoring will help central banks to identify emerging risks and promptly address such risks with effective standards, oversight and policies.”SURVEY DEFINITIONS The BIS defines a CBDC as “a digital payment instrument denominated in the national unit of account, which is a direct liability of the central bank.” A retail CBDC is for use by households and firms for everyday transactions whereas a wholesale CBDC is for transactions between banks, central banks and other financial institutions. Crypto assets are defined as “a type of private sector-issued digital asset that depends primarily on cryptography and distributed ledger or similar technology.”In contrast to CBDCs, they don’t represent a claim on a central bank. Set up in Switzerland in 1930 to settle German reparations arising from World War I, the BIS is the world’s oldest international financial institution. Long dominated by advanced economies, membership expanded rapidly after the Asian financial crisis of 1997 to include dozens of EMDE central banks. Current membership covers 63 jurisdictions.

Singapore Exploring Investment Opportunities in Cambodia

Phnom Penh, August 03, 2023 --Singapore is exploring the opportunities for marketing and investment in Cambodia. A delegation of the Singapore Business Federation (SBF) led by Mr. Gary Lim shared the intention in a meeting with Deputy Prime Minister and Minister of Economy and Finance H.E. Dr. Aun Pornmoniroth on Aug. 1. Twenty-three (23) Singaporean delegation members representing different companies accompanied him to the meeting. Mr. Gary Lim appreciated Cambodia's successful containment of COVID-19, stressing that it is a positive sign for foreign tourists and investors to the Kingdom, including from Singapore.Warmly welcoming the guests, H.E. Dr. Aun Pornmoniroth underlined that the Royal Government of Cambodia will roll out the country's Pentagon Strategy-Phase I for the next five years. The strategy focuses on promoting governance and institutional capacity building, the establishment of favourable environments for social and economic development, and human resource development.It also guides economic diversification and private sector engagement in resilient and inclusive development and digital transformation, he added. Cambodia's economy is expected to accelerate to 5.6 percent in 2023 and 6.6 percent in 2024, while inflation will be around 2.5 percent during these years.

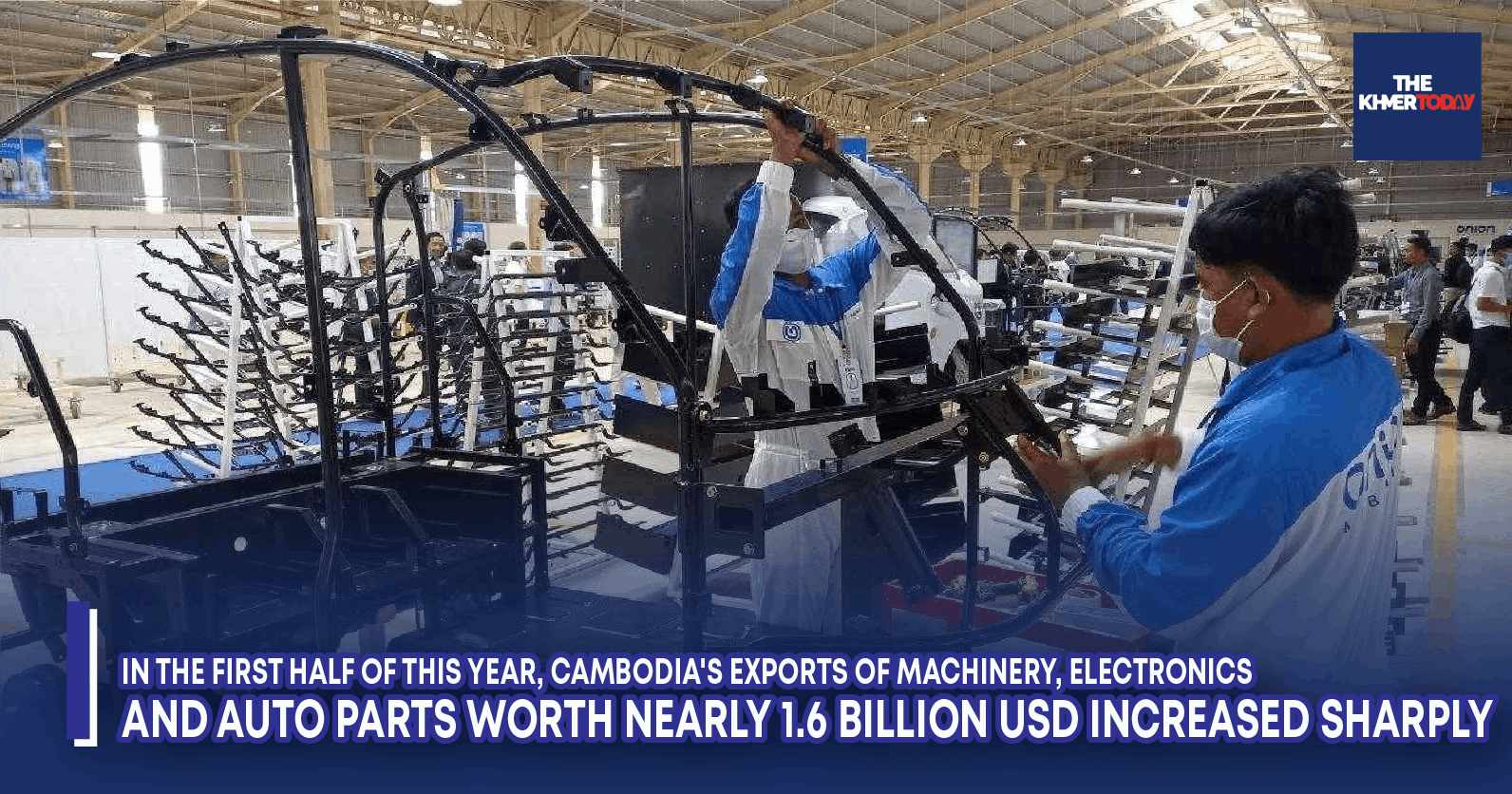

In the first half of this year, Cambodia's exports of machinery, electronics and auto parts worth nearly 1.6 billion USD increased sharply

Cambodia exports 1.58 billion USD worth of machinery, electrical equipment, spare parts, and electronics in the first half of 2023, an increase of 108.7% compared to the same period last year. This is according to data from the General Department of Customs and Excise of Cambodia. The non-garment manufacturing sector continued to maintain strong growth due to the high potential of export-oriented production, while production for the domestic market continued to improve. Cambodia has shown significant positive signs of diversifying its exports in addition to garments to create a stronger economic base and higher value-added. The government aims to turn Cambodia into a high-middle-income country by 2030 and a high-income country by 2050. To achieve this ambition, Cambodia needs to have a strong economic base and turn to producing high-value-added goods. The automotive and electronics sectors have been selected and identified as priority sectors to contribute to the recovery of the Cambodian economy after the Kovid-19 crisis and to promote long-term economic growth, as well as modernization and diversification in line with the "Cambodia Industrial Development Policy 2015-2025."The Royal Government of Cambodia is currently drafting a roadmap for the development of its automotive and electronics sectors, which is expected to increase exports by more than $ 2 billion and create more than 22,000 new jobs in five years, as well as increase new opportunities for local small and medium enterprises in these sectors.At the same time, the Royal Government's policy is shifting away from the garment sector, which consumes a lot of labor but receives low income or value-added, as Cambodia, as well as the world, is approaching the fourth generation of the industrial revolution.

As of the first half of 2023, Chinese direct investment in Cambodia reached more than 20 billion US dollars, an increase of 11.1%

Phnom Penh: Chinese direct investment in Cambodia as of the first half of 2023 amounted to 83.5 trillion riels or about 20.59 billion US dollars, an increase of 11.1% over the same period 2022. This is according to data presented by the National Bank of Cambodia.Most of China's investment in Cambodia is in the manufacturing sector at 31.6%, hydropower at 12.3%, finance at 11%, real estate at 9.8%, hotels and restaurants at 9.1%, construction 7.5%, agriculture 6.1% and others 12.6%.Oknha Lim Heng On, President of the Cambodian Chamber of Commerce, said that the investment of companies from China, we have seen positive signs under the policy of one belt and one road (Silk Road), especially trade agreements. The free trade between Cambodia and China, which we are practicing, is an opportunity for many Chinese companies to invest in our country to produce and export to the Chinese market and other countries such as the European Union and the United States.He added that through the Cambodia-China Free Trade Agreement (CCFTA), the Cambodia-Korea Free Trade Agreement (CKFTA), the Regional Comprehensive Economic Agreement (RCEP) and the Cambodia-Emirates Comprehensive Partnership Agreement. The United Arab Emirates, etc., is very important to help boost Cambodia's economic growth.

Cambodia’s Foreign Reserves Hit US$18.4 Billion as of June

Phnom Penh, August 01, 2023 --Cambodia’s foreign reserves rose to US$18.4 billion as of June 2023, up 3.2 percent from US$17.82 billion at the end of 2022, showed a report of the National Bank of Cambodia (NBC).“The foreign reserves can secure the imports of goods and services for the next seven months,” underlined the report released at the central bank’s biannual meeting held in Preah Sihanouk province on July 30-31.The figure is much higher than the maximum level for developing countries that should have three-month guarantee of imports, it said.The high level of foreign reserves indicates the ability to maintain a stable exchange rate, confidence in the national currency, the basis for foreign borrowing, and provides adequate protection to meet liquidity needs against external crises, stressed the report.International reserves include foreign currencies, gold and SDR (Special Drawing Right), which are under the NBC's control.

Banking Industry’s Outstanding Loan Portfolio Reaches US$56 Billion

Phnom Penh, August 01, 2023 --The outstanding loans in Cambodia’s banking industry reached nearly US$56 billion by June this year, while banks’ deposits rose to more than US$44 billion, according to a report from the National Bank of Cambodia (NBC).Banking institutions’ outstanding loans were recorded at more than US$46 billion, a 12 percent increase year-on-year and outstanding loans at MFIs were US$9.7 billion, up 15 percent, read the report. Banking institutions received deposits of US$39 billion as of June 2023, up 6.4 percent compared to the same period last year while those at the MFIs were US$4.9 billion. The loans were allotted to key sectors such as trade, housing, construction, agriculture, hotels and restaurants and manufacturing, etc.Banking industry has remained strong despite uncertainty of global economic growth, NBC Governor H.E Chea Chanto said at a recapitulative meeting held on July 30-31 in Preah Sihanouk province.The growth in both loans and deposits truly reflected public confidence in the country’s banking system, he said.“The banking industry remains robust and resilient, and it has continued to play an active role in supporting the Kingdom’s economic recovery in the post-COVID-19 pandemic era,” he said.Cambodia has 59 commercial banks, nine specialised banks, and 87 microfinance institutions across the country, with 16.5 million deposit accounts and 3.8 million credit accounts, the report pointed out.The Kingdom has also registered 20.2 million e-wallet accounts, with 30.3 million transactions totally worth US$89.7 billion during the January-June period this year.

Cambodia Issues Government Bond of US$27 Million in H1

Phnom Penh, July 31, 2023 --The government has raised fund through government bond issuance with a total of US$27 million in the first six months of this year, accounting for 13.5 percent of the US$200 million target.The government issues its bonds in the first primary market through the National Bank of Cambodia Auction Platform (NBCP).“In the first semester of 2023, the bidding for government bonds on the NBCP was made six times with a total capital of 112 billion Riel (approximately US$27 million),” the central bank report showed.In 2023, the government plans to raise US$200 million from bonds, which can bring it direct revenues, and ensure investment efficiency and sustainability of debt management and the national budget, according to the Ministry of Economy and Finance.The government bond is not only to complete the annual expenditure but also to contribute to promoting the securities sector in the country.This is the second year of government securities issuance.Investors in government bonds will enjoy a 50 percent deduction of withholding tax on the interest earned from holding and trading the bonds, and tax exemption on capital gains from purchasing and trading the bonds for three years.