Cambodia’s Exports Jump 15 Percent In First 4 Months

Phnom Penh, May 10, 2024 --Cambodia exported a total of US$8,005 million worth of goods in the first four months of this year, up 15.2 percent from US$7,606 million recorded in the same period last year, showed the data from the General Department of Customs and Excise on Friday.The Kingdom’s imports rose by 9.3 percent to US$8,664 million, read the report.According to the same source, the bilateral trade between Cambodia and its trade partners was amounted to US$16,670 million during the January-April period, a 12.1 percent year-on-year increase.The U.S. was the biggest market for Cambodia’s exports with a total of US$2,617 million, followed by Vietnam and China with US$1,713 million and US$486 million, respectively.H.E. Penn Sovicheat, Secretary of State and Spokesperson of the Ministry of Commerce, said that the implementation of the Cambodia-China Free Trade Agreement and the Regional Comprehensive Economic Partnership (RCEP) added momentum to the country’s export growth.“Despite the war crisis and weakening of the purchasing power, Cambodian orders remained high, with the volume of orders remaining unchanged, although there was a decline in some items, but an increase on other items,” he said.The markets in the RCEP members are huge for Cambodia’s products, underlined the spokesperson.

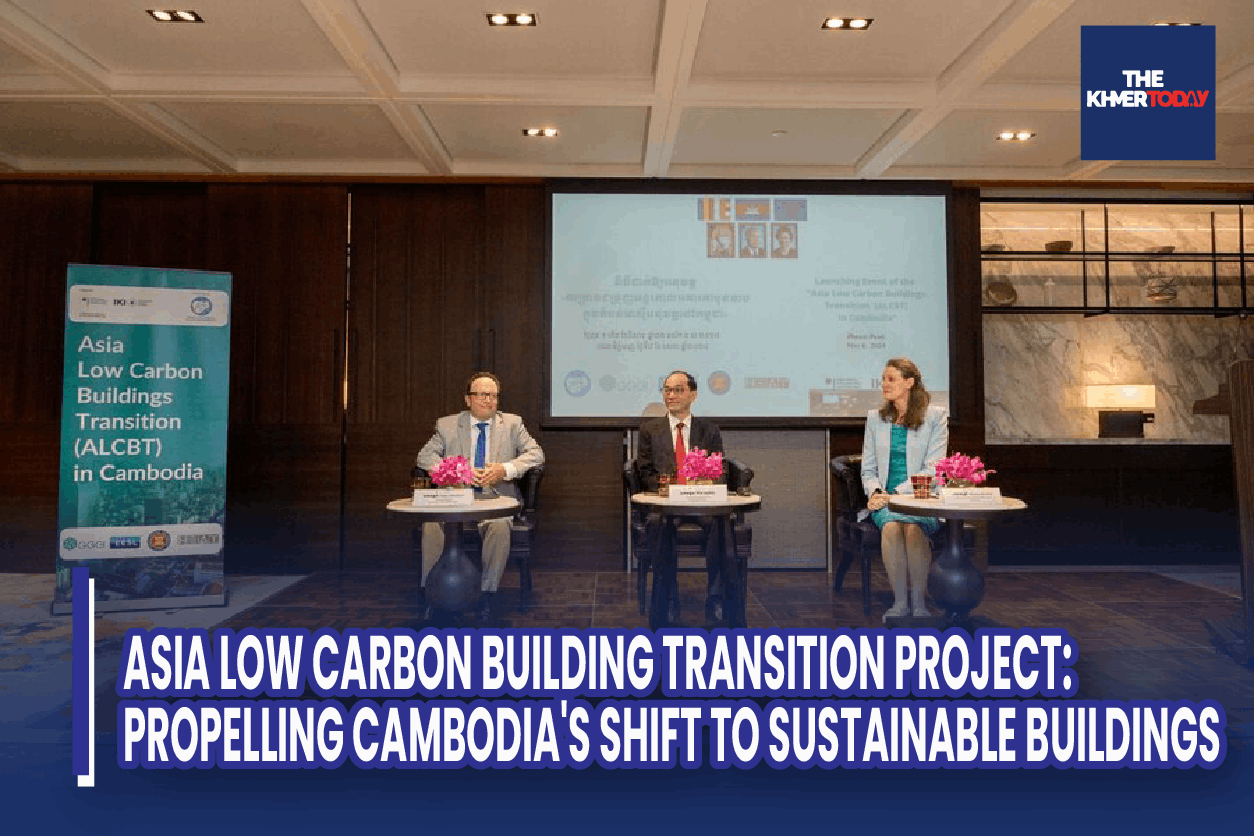

Asia Low Carbon Building Transition Project: Propelling Cambodia's Shift To Sustainable Buildings

Phnom Penh, May 09, 2024 --The Asia Low Carbon Buildings Transition (ALCBT) project was officially launched here on May 8, aiming to achieve a nationwide transition towards low carbon buildings, contributing significantly to the lower energy consumption and greenhouse gas emission reduction in building sector in Cambodia.According to a news release of the German Embassy in Phnom Penh, prior to the COVID-19 pandemic, Cambodia's economy experienced a transformation with an annual growth rate of 7 percent, which led to a boom in the building and construction industry. In 2019, buildings encompassing the residential, commercial, and public sectors accounted for an astounding 43 percent of the nation's total energy consumption. The electricity demand for all sectors is forecasted to increase 6 times at 66 TWh by 2040 without energy efficiency compared to baseline in 2020. In the National Energy Efficiency Policy 2022-2030 (NEEP), the government has set national targets of energy saving by 19 percent of total consumption, and 34 percent and 25 percent in residential and commercial buildings, respectively, by 2030.H.E. Say Samal, Deputy Prime Minister and Minister of Land Management, Urban Planning, and Construction acknowledged, "While Cambodia is relatively new to green building concepts, we recognise the opportunity for eco-friendly and energy-saving in building and construction sector, which could boost growth in the sector and contribute to Cambodia’s commitment to achieve carbon neutrality in 2050 under the Paris Agreement on Climate Change. Therefore, this project will be an instrumental in developing the Low Carbon Tool to support this vision."This five-year project, funded by the German Federal Ministry for Economic Affairs and Climate Action (BMWK) under the International Climate Initiative (IKI), aims to facilitate a nationwide transition to Low Carbon Buildings (LCBs) in Cambodia and four other Asian countries (India, Indonesia, Thailand, and Vietnam). Global Green Growth Institute (GGGI) is leading implementation of ALCBT project along with other consortium partners i.e. ASEAN Centre for Energy (ACE), Energy Efficiency Services Ltd. (EESL), and HEAT International. In Cambodia, the Ministry of Land Management, Urban Planning, and Construction is the government counterpart of the project."Cambodia's booming building sector, driven by stable economic growth, contributes significantly to electricity consumption and greenhouse gas emissions," stated H.E. Stefan Messerer, German Ambassador to Cambodia. "This IKI-funded project is a crucial step in helping Cambodia unlock the full potential of green buildings."Under the project, GGGI and other local partners aim to institutionalise low-carbon performance metrics, enhance industry stakeholder capacity, link building performance to financing options, and share best practices to promote project replication and scaling.Ms. Helena McLeod, Deputy Director-General of GGGI, said, "GGGI has been supporting Cambodia in its green growth journey. So far, we have supported the government for sustainable energy practices in the garment sector, electric mobility, waste management, as well as carbon financing. As for green building, the sector also offers a win-win situation for Cambodia. ALCBT project will help reduce energy consumption and greenhouse gas emissions by and create healthier and more comfortable living and working environments for Cambodians."The project aims to contribute to 1.68 million tCO2eq direct and indirect GHG emission reduction (combined for all project countries) while mobilising €140 (USD XY) million (or US$150 million) worth of investment. In Cambodia, the project will support two policy recommendation outputs (building code enhancement and targets o carbon emissions reduction) to be adopted by the government and eight private and public sector entities to incorporate ALCBT project tools and training programmes.

Cambodia Promotes Investment Potential And Opportunities In Japan

Phnom Penh, May 09, 2024 --Cambodia has promoted her investment potential and opportunities in Japan through a workshop to lure more Japanese investors to the country.Organised in Tokyo on May 8 by the Council for the Development of Cambodia (CDC) in collaboration with ASEAN-Japan Centre (AJC) and Japan External Trade Organisation (JETRO), the workshop was presided over by H.E. SUN Chanthol, Deputy Prime Minister and First Vice President of the CDC, accompanied by H.E. TUY Ry, Ambassador of Cambodia to Japan, with participation of some 150 representatives from foreign missions in Japan, Japan’s Ministry of Economy, Trade and Industry, Japan-Cambodia Friendship Parliamentary League, Japan Cambodia Association and private sector.On the occasion, H.E. SUN Chanthol highlighted Cambodia’s potential to be an investment hub such as political stability, positively stable macroeconomic situation, dynamic young workforce, Royal Government of Cambodia (RGC)’s tendency to support business growth, attractive and favourable investment scheme, intermodal infrastructure being developed interconnectedly, and more.The CDC vice president was optimistic that Japanese businessmen and investors would visit Cambodia to study business and investment opportunities in person, and bring back current investment environment in Cambodia to Japanese business community in a greater extent.Guest speakers from the private sector also joined in the discussion forum about investment potentials in new areas in Cambodia, by stressing the ease of doing business, diversification of investment activities, and RGC’s proactive policy support on renewable energy, green production chain, and digital economy that are in line with regional and global tendency.H.E. SUN Chanthol also chaired the launch of business matching meeting programme between Cambodia Oknha Association, Cambodia Chamber of Commerce, and Japan Cambodia Association, followed by an interview given to Nikkei.

Cambodia Promotes Investment Potential And Opportunities In Japan

Phnom Penh, May 09, 2024 --Cambodia has promoted her investment potential and opportunities in Japan through a workshop to lure more Japanese investors to the country.Organised in Tokyo on May 8 by the Council for the Development of Cambodia (CDC) in collaboration with ASEAN-Japan Centre (AJC) and Japan External Trade Organisation (JETRO), the workshop was presided over by H.E. SUN Chanthol, Deputy Prime Minister and First Vice President of the CDC, accompanied by H.E. TUY Ry, Ambassador of Cambodia to Japan, with participation of some 150 representatives from foreign missions in Japan, Japan’s Ministry of Economy, Trade and Industry, Japan-Cambodia Friendship Parliamentary League, Japan Cambodia Association and private sector.On the occasion, H.E. SUN Chanthol highlighted Cambodia’s potential to be an investment hub such as political stability, positively stable macroeconomic situation, dynamic young workforce, Royal Government of Cambodia (RGC)’s tendency to support business growth, attractive and favourable investment scheme, intermodal infrastructure being developed interconnectedly, and more.The CDC vice president was optimistic that Japanese businessmen and investors would visit Cambodia to study business and investment opportunities in person, and bring back current investment environment in Cambodia to Japanese business community in a greater extent.Guest speakers from the private sector also joined in the discussion forum about investment potentials in new areas in Cambodia, by stressing the ease of doing business, diversification of investment activities, and RGC’s proactive policy support on renewable energy, green production chain, and digital economy that are in line with regional and global tendency.H.E. SUN Chanthol also chaired the launch of business matching meeting programme between Cambodia Oknha Association, Cambodia Chamber of Commerce, and Japan Cambodia Association, followed by an interview given to Nikkei.

Asia Low Carbon Building Transition Project: Propelling Cambodia's Shift To Sustainable Buildings

Phnom Penh, May 09, 2024 --The Asia Low Carbon Buildings Transition (ALCBT) project was officially launched here on May 8, aiming to achieve a nationwide transition towards low carbon buildings, contributing significantly to the lower energy consumption and greenhouse gas emission reduction in building sector in Cambodia.According to a news release of the German Embassy in Phnom Penh, prior to the COVID-19 pandemic, Cambodia's economy experienced a transformation with an annual growth rate of 7 percent, which led to a boom in the building and construction industry. In 2019, buildings encompassing the residential, commercial, and public sectors accounted for an astounding 43 percent of the nation's total energy consumption. The electricity demand for all sectors is forecasted to increase 6 times at 66 TWh by 2040 without energy efficiency compared to baseline in 2020. In the National Energy Efficiency Policy 2022-2030 (NEEP), the government has set national targets of energy saving by 19 percent of total consumption, and 34 percent and 25 percent in residential and commercial buildings, respectively, by 2030.H.E. Say Samal, Deputy Prime Minister and Minister of Land Management, Urban Planning, and Construction acknowledged, "While Cambodia is relatively new to green building concepts, we recognise the opportunity for eco-friendly and energy-saving in building and construction sector, which could boost growth in the sector and contribute to Cambodia’s commitment to achieve carbon neutrality in 2050 under the Paris Agreement on Climate Change. Therefore, this project will be an instrumental in developing the Low Carbon Tool to support this vision."This five-year project, funded by the German Federal Ministry for Economic Affairs and Climate Action (BMWK) under the International Climate Initiative (IKI), aims to facilitate a nationwide transition to Low Carbon Buildings (LCBs) in Cambodia and four other Asian countries (India, Indonesia, Thailand, and Vietnam). Global Green Growth Institute (GGGI) is leading implementation of ALCBT project along with other consortium partners i.e. ASEAN Centre for Energy (ACE), Energy Efficiency Services Ltd. (EESL), and HEAT International. In Cambodia, the Ministry of Land Management, Urban Planning, and Construction is the government counterpart of the project."Cambodia's booming building sector, driven by stable economic growth, contributes significantly to electricity consumption and greenhouse gas emissions," stated H.E. Stefan Messerer, German Ambassador to Cambodia. "This IKI-funded project is a crucial step in helping Cambodia unlock the full potential of green buildings."Under the project, GGGI and other local partners aim to institutionalise low-carbon performance metrics, enhance industry stakeholder capacity, link building performance to financing options, and share best practices to promote project replication and scaling.Ms. Helena McLeod, Deputy Director-General of GGGI, said, "GGGI has been supporting Cambodia in its green growth journey. So far, we have supported the government for sustainable energy practices in the garment sector, electric mobility, waste management, as well as carbon financing. As for green building, the sector also offers a win-win situation for Cambodia. ALCBT project will help reduce energy consumption and greenhouse gas emissions by and create healthier and more comfortable living and working environments for Cambodians."The project aims to contribute to 1.68 million tCO2eq direct and indirect GHG emission reduction (combined for all project countries) while mobilising €140 (USD XY) million (or US$150 million) worth of investment. In Cambodia, the project will support two policy recommendation outputs (building code enhancement and targets o carbon emissions reduction) to be adopted by the government and eight private and public sector entities to incorporate ALCBT project tools and training programmes.

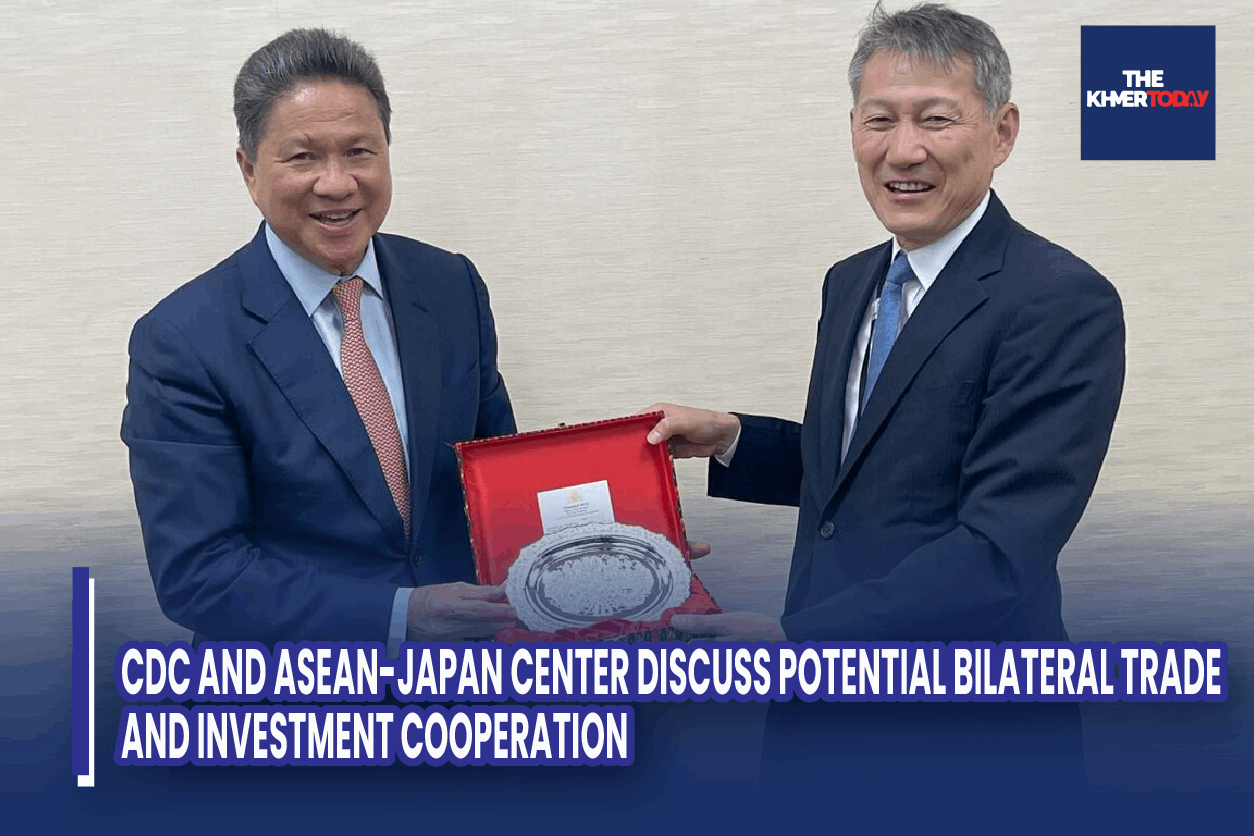

CDC And ASEAN-Japan Center Discuss Potential Bilateral Trade And Investment Cooperation

Phnom Penh, May 08, 2024 --The Council for the Development of Cambodia (CDC) and ASEAN-Japan Centre (AJC) have discussed possible bilateral trade and investment opportunities and cooperation to attract more Japanese investors to Cambodia.The discussion was held between H.E. SUN Chanthol, Deputy Prime Minister and First Vice President of CDC, accompanied by H.E. Tuy Ry, Ambassador of Cambodia to Japan, and H.E. Kunihiko Hirabayashi, Secretary General of AJC, in Tokyo of Japan, on May 7.On the occasion, H.E. SUN Chanthol informed H.E. Kunihiko Hirabayashi about Cambodia’s investment environment which is open, attractive and easy for investment in all sectors as well as the Royal Government’s commitment to maintain political stability, macro-economic stability and supporting policies, aiming to transform Cambodia into a high-income economy by 2050.The CDC vice president also took the opportunity to brief the Japanese side about law condition, technical study, and environmental impact assessment of Funan Techo Canal, a historic project that link Cambodian river to the sea.For his part, H.E. Kunihiko Hirabayashi expressed AJC’s support to the future cooperation with Cambodia. He was convinced that the 7th-mandate Royal Government of Cambodia will attract more and more investment to the country.On the same day, H.E. SUN Chanthol also met separately with H.E. Hosaka Shin, Vice Minister of International Affairs at Ministry of Economy, Trade and Industry (METI), and H.E. Imamura Masahiro, President of the Japan-Cambodia Parliamentary Friendship Association, to exchange views on future cooperation between CDC and METI and between CDC and the Japan-Cambodia Parliamentary Friendship Association.H.E. SUN Chanthol requested the Japanese side to attract more Japanese investors to Cambodia through their feasibility study of investment environment with the expansion of production chain and supply chain in the Kingdom, as well as thanked the Government of Japan and her people for their support to the socio-economic development of Cambodia since the 1990s.H.E. SUN Chanthol and his delegation have been paying a three-day visit in Japan from May 7 to 9 to further encourage more Japanese investors to come to invest in Cambodia.

Japan, A Key Trading Partner Of Cambodia

Phnom Penh, May 06, 2024 --Cambodia has considered Japan one of her key trading partners for the national socio-economic development and encouraged more Japanese investment to the country.The remarks were made by H.E. LIM Lork Piseth, Secretary of State at the Ministry of Commerce, while presiding over late last week at Yoyogi Park, Tokyo the Opening Ceremony of the 8th Cambodia Festival 2024, organised by the Royal Embassy of Cambodia in Japan, in collaboration with the Cambodia Festival Committee, Khmer Community, Cambodian and Japanese students.On the occasion, H.E. LIM Lork Piseth shared information about the progress of current trade and economic growth, as well as the investment and tourism potential in Cambodia, and took the opportunity to encourage more Japanese investors and companies to consider investing in Cambodia after a large number of globally recognised Japanese companies opened their businesses in the country, such as Minebea, Aeon Mall, and most recently Toyota Tsusho Manufacturing Corporation (Cambodia).The Opening Ceremony was jointly presided over by H.E. TUY Ry, Ambassador of Cambodia to Japan, H.E. IMAMURA Masahiro, Member of the House of Representative and Chairperson of Japan-Cambodia Friendship Parliamentary Association and H.E. HOSAKA Yasushi, Parliamentary Vice-Minister of Foreign Affairs of Japan.The Cambodia Festival is held every year to promote Cambodian culture, arts, tourism, potential products, and food to the Japanese community and international guests. This year's event attracted more than 90 booths, including seven companies from Cambodia, to showcase and promote a wide range of Cambodian food and potential products.Besides, there were traditional Khmer dance performances by various art groups from the Cambodia’s Ministry of Culture and Fine Arts, the dance troupes performed by Cambodian boys and girls in Japan, contemporary music, traditional Khmer costumes modeled by the Cambodian Students’ Association in Japan, as well as Kun Khmer martial arts performances. The excitement around the Cambodia Festival attracted more than 30,000 visitors on the first day of the of the event.

CDC Committed To Becoming High-Level Consultant Institution For All Investors

Phnom Penh, May 03, 2024 --The Council for the Development of Cambodia (CDC) is committed to becoming a high-level consultant institution to all investors by providing them with key information about Cambodia so that they have sufficient and clear basis before deciding to invest in the Kingdom.The commitment was made by H.E. Sun Chanthol, Deputy Prime Minister and First Vice President of the CDC, while he was receiving a courtesy call from Mr. Paul Clements, Executive Chairperson of the International Business Chamber (IBC) of Cambodia, at the CDC headquarters here recently.According to H.E. Sun Chanthol, the CDC has been upgrading its qualified investment project (QIP) registration to ease investment registration of all investors in the country.On the occasion, the CDC vice president also briefed his guest about the Funan Techo Canal Project – a historical waterway transport project linking Cambodian river to the sea route – whose study had been thoroughly conducted by 48-member technical team and international consultants using international standards and technologies, including drones and satellite.H.E. Sun Chanthol reassured that the Funan Techo Canal Project provides no negative impact on Cambodian environment and that of neighbouring countries, but it would contribute to the reduction of greenhouse gas emissions into the atmosphere.For his part, Mr. Paul Clements informed H.E. Sun Chanthol about IBC's mission in Cambodia over the last three decades, and its active participation with the Royal Government of Cambodia (RGC), particularly in the Working Group D of the 19th Government-Private Sector Forum.The IBC chairperson also mentioned about the IBC's work direction and action plan such as creating opportunities for members of chambers of commerce in Cambodia, such as Cambodia Chamber of Commerce (CCC) and American Chamber of Commerce (AmCham) to discuss and share experience to attract more investment to the Kingdom.

Intellectual Property, A Key Tool To Promote Trade, New Businesses And FDI

Phnom Penh, May 02, 2024 --Intellectual property is an essential tool for promoting trade in goods and services, new businesses and micro, small and medium enterprises, and foreign direct investment (FDI) through value added, commercialisation, creation of source of finance, innovation promotion, and research and development through technology transfer.The remarks were made by H.E. Mrs. Cham Nimul, Minister of Commerce and Chair of the National Committee for Intellectual Property, while she and H.E. Hem Vanndy, Minister of Industry, Science, Technology & Innovation, were presiding over the World Intellectual Property Day 2024, at Hyatt Regency Phnom Penh on April 30.The commerce minister also requested all stakeholders to work together to prevent intellectual property infringement, which is an obstacle to innovation, and strongly hoped that the Intellectual Property Day 2024 will continue to cultivate a common spirit in promoting awareness raising campaigns, which is closely linked to the people’s lives and benefits all areas of society.For his part, H.E. Hem Vanndy spoke highly of the World Intellectual Property Day, saying that it serves as an important platform to raise awareness about intellectual property, technological advancement and innovation among the public, especially innovators, researchers, and students.At the end of the celebration, H.E. Mrs. Cham Nimul and H.E. Hem Vanndy presided over the launching ceremony of five intellectual property-related projects, including: 1) Inclusive Growth Project: Promoting Cambodian Entrepreneurs with Disabilities through Intellectual Property Education and Business Branding, (2) Project for Skill-based Learning and Mentoring for Design School, (3) Launch of IP Web Application, (4) Launch of Distance Learning Platform on Intellectual Property, and (5) Launch of Intellectual Property Analysis Programme for Business.This year’s celebration of the World Intellectual Property Day 2024 was held under the theme “IP and SDGs: Building our common future with innovation and creativity.”

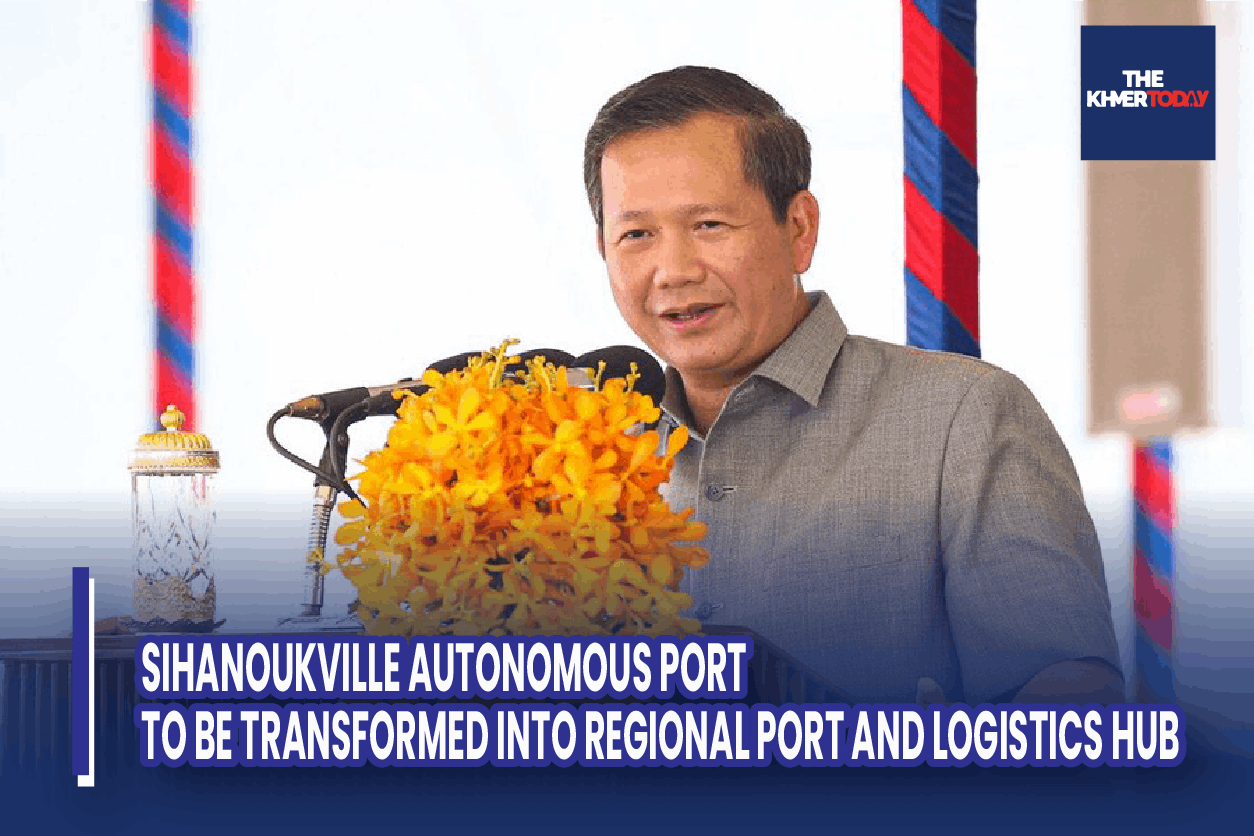

Sihanoukville Autonomous Port To Be Transformed Into Regional Port And Logistics Hub

Phnom Penh, May 01, 2024 --The Royal Government of Cambodia has an ambition to develop Sihanoukville Autonomous Port in Preah Sihanouk province into not only a deep seaport in Cambodia, but also a regional port and logistics hub by 2050.The ambition was highlighted by Prime Minister Samdech Moha Borvor Thipadei Hun Manet at a get-together with civil servants, workers and employees at the Sihanoukville Autonomous Port this morning, on the occasion of the 138th anniversary of the International Labour Day (May 1) under the theme “One enterprise as One Peaceful Community”.The Premier added that the port sector is one of the priority sectors to which the Royal Government pays attention by increasing investment funds and mobilising financing to further develop the port infrastructure.Sihanoukville Autonomous Port is considered as a national economic gateway with character as a strategic entity in supporting international trade activities for economic growth in the past, at present and in the future, he said, stressing that this port not only increases revenue on the spot, but can also be a driving force for economic growth in Sihanoukville as well as the country’s whole coastal region.According to H.E. Peng Ponea, Minister of Public Works and Transport, the Sihanoukville Autonomous Port plans to further expand its capacity through the construction project of a new deep container terminal-phase 2 of 400 metres long and 16.5 metres deep, and the phase 3 of 430 metres long and 17.5 metres deep, along with supporting modern technical equipment.The phase 1 began in December 2023 under the presidency of Prime Minister Samdech Moha Borvor Thipadei Hun Manet and H.E. Ishibashi Rintaro, Parliamentary Vice Minister of Land, Infrastructure, Transport and Tourism of Japan.The construction project of the 350-metre-long-and-14.5-metres-deep container terminal-phase 1 will last 36 months and cost some US$243 million, an ODA loan from the Government of Japan.Once in operation, the new container terminal-phase 1 will be able to handle 93 percent of regional vessels, up from the current 18 percent, while the costs of sea freight will be reduced by US$200 per TEU, a similar cost to that of other countries in the region.

Cambodia, Türkiye To Increase Trade Exchange And Strengthen People-To-People Relations

Phnom Penh, April 29, 2024 --The Kingdom of Cambodia and the Republic of Türkiye have agreed to boost their bilateral trade exchange to US$1 billion in the future and the people-to-people relations through expansion of education cooperation and direct flights between the two nations.The remarks were made by H.E. Ms. Ülkü Kocaefe while paying here at the Senate Palace this morning a courtesy call on Samdech Akka Moha Sena Padei Techo Hun Sen, President of the Senate of Cambodia.The Turkish ambassador expressed her congratulations to Samdech Techo Hun Sen on his appointment as Senate President, hoping to see the relationship between the two countries’ parliament will be brought to a new level.In reply, Samdech Techo Hun Sen spoke highly of the relationship between Cambodia and Türkiye and was convinced that the goal of US$1-billion trade exchange will be achieved.Regarding direct flights between Türkiye and Cambodia, he continued, it would be possible for tourists from neighbouring Türkiye to use Türkiye as a starting point for their travel to Cambodia.Samdech Techo Hun Sen reaffirmed his commitment to further tighten the parliamentary relations between both countries, stressing that in this fifth legislature, the Senate of Cambodia will focus on foreign affairs.He took the opportunity to invite the president of the Turkish Parliament to attend an Inter-Parliamentary Forum on Tolerance and Peace and the 12th General Assembly of the International Conference of Asian Political Parties (ICAPP) to be hosted by Cambodia in November this year.Samdech Thipadei Prime Minister of Cambodia will chair the ICAPP General Assembly, and Samdech Techo Hun Sen will be invited to be the Honorary Chairman.The Senate President and H.E. Ambassador of Türkiye also discussed regional and international issues of common concern, especially the Russia-Ukraine war and the situation in the Middle East.Cambodia and Türkiye mark this year the 65th anniversary of the embellishment of their diplomatic ties.

Investors Encouraged To Invest In Cambodia-China Industrial Park

Phnom Penh, April 25, 2024 —Cambodia and China have organised bilateral trade and investment promotion meeting to boost investment in their Industrial Park.The event took place at Sokha Phnom Penh Hotel on April 24 under the presidency of H.E. SEANG Thay, Secretary of State at the Ministry of Commerce.According to the ministry, the purpose of this meeting is to promote the important projects of the Cambodia-China Industrial Park and attract the attention of Cambodian, Chinese, and foreign businessmen as well as investors to explore investment opportunities in the industrial park in both the Guangxi Zhuang Autonomous Region, the People's Republic of China, and the Kingdom of Cambodia.This event also featured presentations from guest speakers from the Ministry of Agriculture, Forestry and Fisheries (MAFF) and the Council for the Development of Cambodia (CDC).Leaders from the General Directorate of Trade Promotion, delegations of the Department of Commerce of the Guangxi Zhuang Autonomous Region, representatives and members of the Cambodian Chamber of Commerce, as well as Cambodian and Chinese investors and businessmen participating in the meeting.

Government To Allocate Over US$170 Million To Develop Health Centres

Phnom Penh, April 20, 2024 --The Royal Government of Cambodia has decided to allocate more than US$170 million to strengthen the capacity of health centres across the country.The commitment was highlighted by Prime Minister Samdech Moha Borvor Thipadei Hun Manet at the official inauguration of the Japan-funded Centre of Surgical Service of Siem Reap Provincial Referral Hospital in the provincial city this morning.Samdech Thipadei Hun Manet added that the Royal Government has set out a strategic plan to strengthen all health centres in the country by allocating more budget, modernising them, and increasing the number of heath staff with doctors on duty 24 hours a day.The health centres will also be equipped with ambulances to transport patients to referral hospitals or higher-level hospitals, he said.The Premier also underlined the importance of strengthening the regional hospitals to ensure the efficiency of treatment and reduce the burden of coming to Phnom Penh capital for medical treatment, especially to save the people’s lives in a timely manner.Samdech President Hun Manet advised all medical practitioners to provide health services to the people with professional ethics, without any bias, ensuring that no citizen is discriminated against for any reason.

Cambodia And China Highly Value The Strong Development Of Bilateral Relations In All Sectors

On 21 April 2024, His Excellency SOK Chenda Sophea, Deputy Prime Minister and Minister of Foreign Affairs and International Cooperation, had a productive bilateral meeting with His Excellency WANG Yi, Member of the Political Bureau of the Communist Party of China Central Committee, Director of the Office of the Central Commission for Foreign Affairs and Minister of Foreign Affairs of the People’s Republic of China, during the latter’s official visit to Cambodia.Both sides highly valued the strong development of bilateral relations in all sectors under the Comprehensive Strategic Partnership of Cooperation and the building of a high-quality, high-level, and high-standard Cambodia-China Community with a Shared Future.The two sides agreed on the importance of frequent and active exchanges of visits and engagements between their respective leaders, which demonstrates the robust political trust and the iron-clad friendship between the two countries.Enhancement of the Diamond Cooperation Framework, people-to-people exchanges, and the joint development of “Industrial and Technological Corridor” and “Fish and Rice Corridor”, as well as the cooperation in the fields of infrastructure, energy, economy, and trade were among the topics discussed. In addition to the bilateral cooperation, the two Foreign Ministers also exchanged views on regional and international issues of common concerns.

Cambodia’s Economic Growth To Accelerate In 2024, Fueled By Manufacturing And Tourism, Says ADB

Phnom Penh, April 11, 2024 --Cambodia’s economy is forecast to grow at 5.8 percent in 2024 and 6.0 percent in 2025, fueled by a further rebound in tourism and strong manufacturing prospects, according to the latest edition of the Asian Development Bank’s (ADB) flagship economic report released on April 11."Despite global economic challenges, Cambodia’s economy performed well in 2023,” said ADB Country Director for Cambodia Ms. Jyotsana Varma. “We expect growth to be robust in 2024-2025, with the garments, footwear, and travel goods (GFT) sector poised for a significant upturn building on the positive momentum during the last quarter of 2023.”The Asian Development Outlook (ADO) April 2024 estimated growth of 5.0 percent in 2023, driven by a robust recovery in tourism and solid activity in manufacturing outside the GFT sector. The report forecasts continuing economic expansion in 2024–2025, supported by stronger export-oriented manufacturing. It also expects inflation, which averaged 2.1 percent in 2023 mainly on falling global energy prices, to remain low at around 2.0 percent over the next two years.The government aims for gradual fiscal consolidation from 2024 to rebuild pandemic-diminished reserves. Yet, challenges such as potential global economic slowdowns, rising private debt, fluctuating energy prices, and climate vulnerabilities could impact the outlook longer-term.“These challenges add layers of complexity to Cambodia’s economic narrative,” said Ms. Varma. “But, the country is moving ahead with cautious optimism.”The report also discusses Cambodia’s strategic preparations to graduate from the least-developed country (LDC) category, as designated by the United Nations, in 2027. It notes that graduation will improve the country’s international standing and investment attractiveness, but simultaneously pose challenges from reduced access to concessional financing and preferential trade treatments that propel sectors contributing to high growth and employment.To effectively navigate this transition, the report stresses the importance of Cambodia enhancing its global economic integration, diversifying markets, focusing on higher value-added products, investing in sustainable infrastructure and human capital, and strengthening domestic resource mobilisation.Recently, Cambodia was ranked by Seasia Stats as the fastest growing economy in Southeast Asia, and third in Asia in 2024 by basing on the International Monetary Fund (IMF)’s October 2023 Outlook and January 2024 update, which forecasted Cambodia’s economic growth at 6.1 percent this year.For the government side, Cambodian economy remains robust with a projected growth rate of 6.6 percent in 2024, up from 5.6 percent last year, while the World Bank has forecasted that the Kingdom’s economy would grow at 5.8 percent this year.

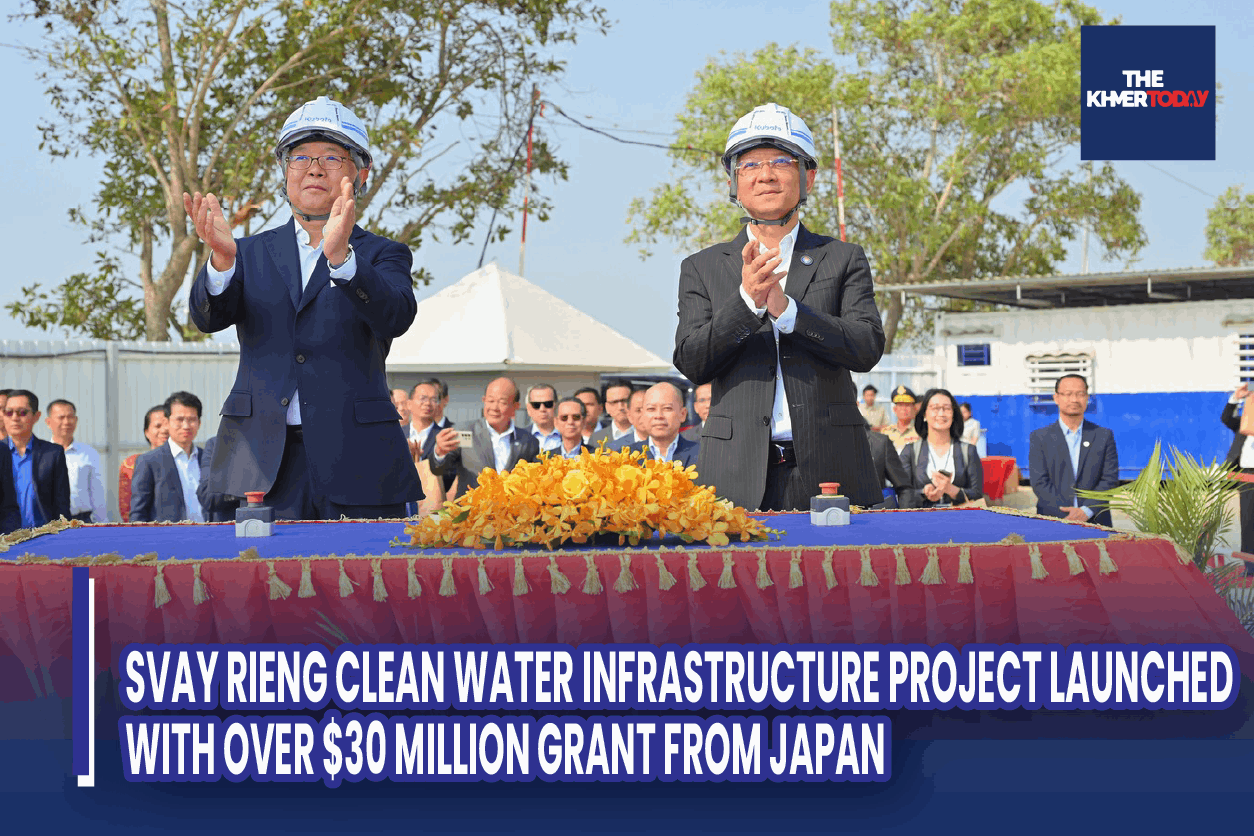

Svay Rieng Clean Water Infrastructure Project Launched With Over $30 Million Grant From Japan

Phnom Penh 11-04-2024The Ministry of Industry, Science, Technology & Innovation hosted a groundbreaking ceremony for the Svay Rieng Water Supply System Expansion Project on April 11, 2024 to bolster clean water access in Svay Rieng Province. The project is funded by a Japanese grant of over USD 30 million via Japan International Cooperation Agency (JICA), which marks another key moment for the development of clean water infrastructure in Svay Rieng province.The groundbreaking ceremony was presided over by H.E. Hem Vanndy, Minister of Industry, Science, Technology & Innovation, and H.E. UENO Atsushi, Ambassador of Japan to Cambodia, with the participation of about 600 individuals, including representatives from MISTI, relevant ministries-institutions, Embassy of Japan in Cambodia, JICA, Kitakyushu City Administration, Svay Rieng Provincial Administration, Svay Rieng Provincial Department of Industry, Science, Technology & Innovation, local authorities, and communities.Svay Rieng Province has witnessed notable developmental in recent years, with advancements in physical infrastructure and robust economic and social progress. Amidst this growth, the demand for clean water has steadily risen. Svay Rieng City, serviced by the Svay Rieng Water Supply Authority, has faced challenges due to limited water production capacity—just 4,800 cubic meters per day, catering to just over 20,000 people, approximately 40% of the population in 2017.In response to the increasing demand for clean water for various purposes, including daily consumption, business, and industrial needs in the province, MISTI sought assistance from the Government of Japan to initiate the construction of a new water supply system expansion.As a result, the Japanese government, through JICA, has provided a grant of approximately 3.986 million yen or 30.6 million US dollars to implement the project, scheduled to span 23 months from February 2024 to December 2025.The project encompasses a raw water pumping station with a capacity of 7,480 m3/day, a 2.9 km raw water pipeline, a water treatment plant capable of processing 6,800 m3/day, and a water supply network spanning 110 km. Additionally, 375 home connections will be established, along with the construction of a 22m x 17.7m administrative building.Upon completion, the Svay Rieng Water Supply Authority is expected to elevate its water production capacity to 22,600 m3/day, serving a distribution network of 236.64 km. This expansion is anticipated to provide quality, safe and sustainable clean water access to more than 117,530 individuals residing in Svay Rieng City and Svay Chrum District by the end of 2025. The project will contribute to the Svay Rieng Water Supply Authority's achievement of the government's target of "expanding the city's water supply to 100% of the people by 2025 to serve the basic needs of the people as well as for production and service sectors.”The Svay Rieng Water Supply System Expansion Project underscores the government’s commitment to enhancing the well-being of citizens, driving socio-economic progress, and fostering an environment conducive to attracting investment to Svay Rieng Province.

ASEAN Secretariat Ready To Collaborate With Cambodia In ASEAN Community Building

Phnom Penh, April 11, 2024 --The ASEAN Secretariat is committed to working closely with Cambodia in contributing to the ASEAN Community building process.The commitment was reaffirmed by H.E. Dr. Kao Kim Hourn, Secretary-General of ASEAN, in a message to Samdech Akka Moha Sena Padei Techo Hun Sen, congratulating him on his recent election as the President of the Fifth Legislature of the Senate.“On behalf of the ASEAN Secretariat and on my own behalf, I would like to extend my warmest congratulations on your recent election as the President of the Senate of the Kingdom of Cambodia. It is indeed a remarkable achievement and a true testament of your exceptional leadership qualities as well as life-long dedication to public service,” he wrote.The ASEAN secretary-general expressed his belief that with Samdech Techo Hun Sen’s extensive experience and leadership in the executive branch serving as former Foreign Minister, Deputy Prime Minister and Prime Minister of the Kingdom of Cambodia, will greatly contribute to the progress and development of the Senate as well as to the overall advancement and transformation of the Kingdom of Cambodia.“I am confident that under your guidance and wise leadership, the Senate will effectively fulfill its roles and responsibilities and will largely contribute to the ongoing efforts of the ASEAN Community building in fostering regional cooperation, peace, and stability. In this regard, I wish to reaffirm that the ASEAN Secretariat stands ready to working closely with you and Cambodia in contributing to the ASEAN Community building process, especially as we have embarked on the crafting of the ASEAN Community Vision 2045 that would shape ASEAN's long-term strategic environment in the next two decades,” he underlined.H.E. Dr. Kao Kim Hourn looked forward to working closely with Samdech Techo Hun Sen to further strengthen the ties between ASEAN and the Kingdom of Cambodia and to the opportunity to officially pay a courtesy call on Samdech President at an opportune time in the near future during his visit to Cambodia.

Manhattan SEZ Chairman Wishes To Expand Business In Cambodia

Phnom Penh, April 10, 2024 --Mr. Clement Yang, Chairman of Manhattan Special Economic Zone (SEZ) in Bavet city, Svay Rieng province has voiced his wish to expand more business in Cambodia through investment in areas of agriculture, green energy, transport and logistics.The intention was revealed by Mr. Clement Yang while he was paying a courtesy call on H.E. SUN Chanthol, Deputy Prime Minister and First Vice President of the Council for the Development of Cambodia (CDC), with participation of Mr. Hong Kian Lim, CEO of Surbana Jurong (SJ) Group of Singapore, to discuss further possible investment in the above-said sector in the Kingdom, at the CDC headquarters on April 9.According to Mr. Clement Yang, Manhanttan SEZ would collaborate with major companies such as SJ Group and Suzhou Industrial Park in Jiangsu of China.For his part, H.E. SUN Chanthol welcomed the investment plans and reassured that the CDC would provide facilitation for all investments in Cambodia in accordance with the laws and regulations of the country.

Cambodia, The Fastest Growing Economies In Southeast Asia, And Third In Asia In 2024

Phnom Penh, April 06, 2024 --Cambodia leads the growth projection in Southeast Asia in 2024, according to Seasia Stats based on Southeast Asia’s 2024 GDP growth projection from the IMF’s October 2023 Outlook and January 2024 update.“Cambodia tops the list with 6.1 percent, while the Philippines ranks second with 5.9 percent and Vietnam third with 5.8 percent,” the source said.For Asia, the Kingdom sits third among the top 25 fastest growing economies in Asia in 2024, just behind Macao and India with 27.2 and 6.3 percent, respectively.The rankings show the ability of the new Royal Government of Cambodia under the leadership of Samdech Moha Borvor Thipadei Hun Manet, especially to boost the economic recovery after the COVID-19 crisis and the Ukraine-Russia war crisis.Cambodia’s economy is mainly driven by garment, footwear and travel goods exports, tourism, agriculture, and real estate and construction.

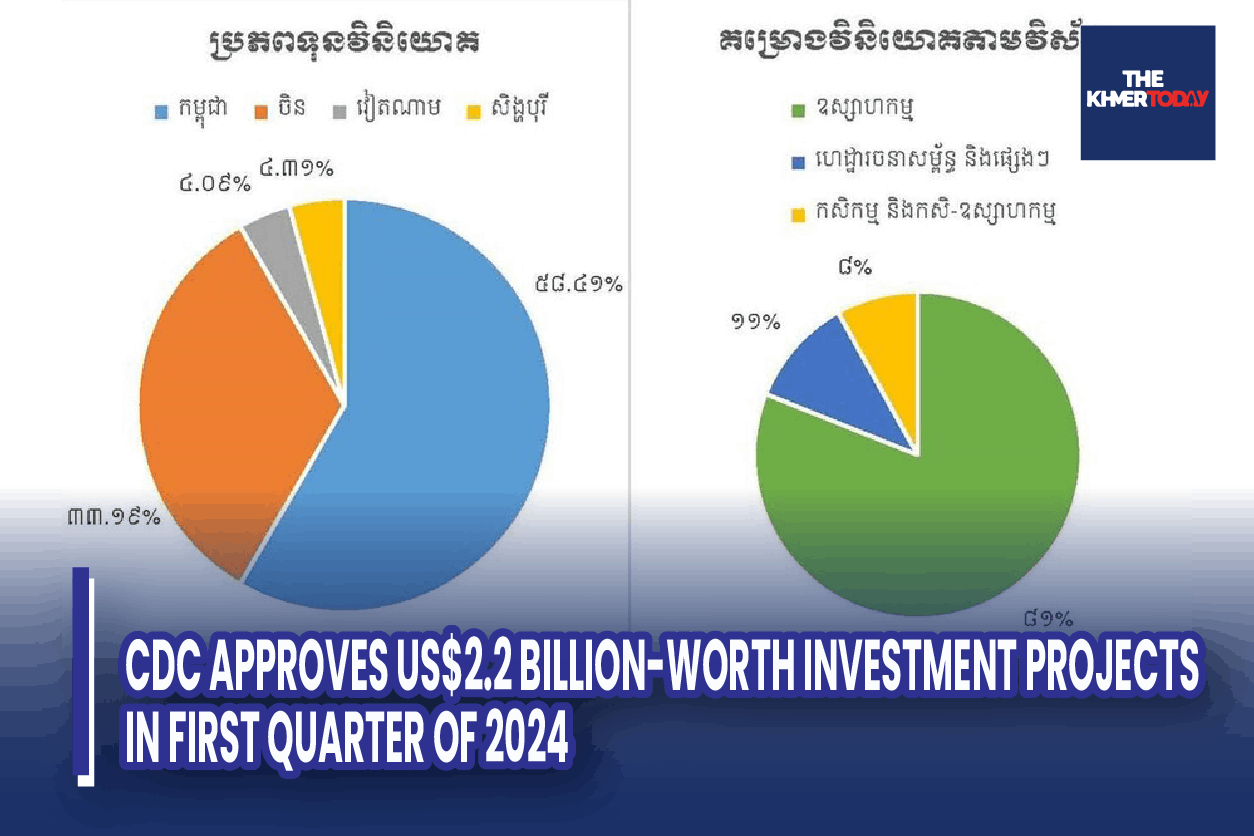

CDC Approves US$2.2 Billion-Worth Investment Projects In First Quarter Of 2024

Phnom Penh, April 05, 2024 --The Council for the Development of Cambodia (CDC) has approved 106 investment and investment expansion projects in the first three months of this year, an increase of 67 projects compared to the same period last year.The total investment capital of the approved projects in the first quarter rose by 649 percent year-on-year to US$2.2 billion, pointed out a CDC’s press release made public this morning.The same source stated that the newly endorsed investment projects are expected to generate some 107,000 jobs for local people.Breaking down by sectors, it underlined, investment in industrial sector got the largest share with 90.57 percent, while agriculture and agro-industry, infrastructure, and tourism accounted for 3.77 percent, 3.77 percent, and 1.89 percent, respectively.About 58 percent of the total investment capital was from local investors, 35.34 percent from China, 3.16 percent from Singapore, 2.23 percent from Vietnam, and the rest from South Korea, the U.S. and Malaysia, the press release showed.Vice-President of the Cambodia Chamber of Commerce Mr. Lim Heng attributed the increase in investment project to the country’s potential under the new investment law, free trade agreements, mega-regional pact, and trade preferences.“The new investment law, along with free trade agreements – Cambodia-China FTA and Cambodia-Korea FTA, RCEP – are factors that attracted investment from China to Cambodia as part of production for exports to foreign markets,” he said.