National Banks of Cambodia and Malaysia Sign Landmark Agreement to Advance Financial Innovation

Phnom Penh: The National Bank of Cambodia (NBC) and Bank Negara Malaysia (BNM) have finalized a Memorandum of Understanding (MoU) dedicated to strengthening financial innovation and payment systems in an effort to modernize financial transactions between Cambodia and Malaysia.

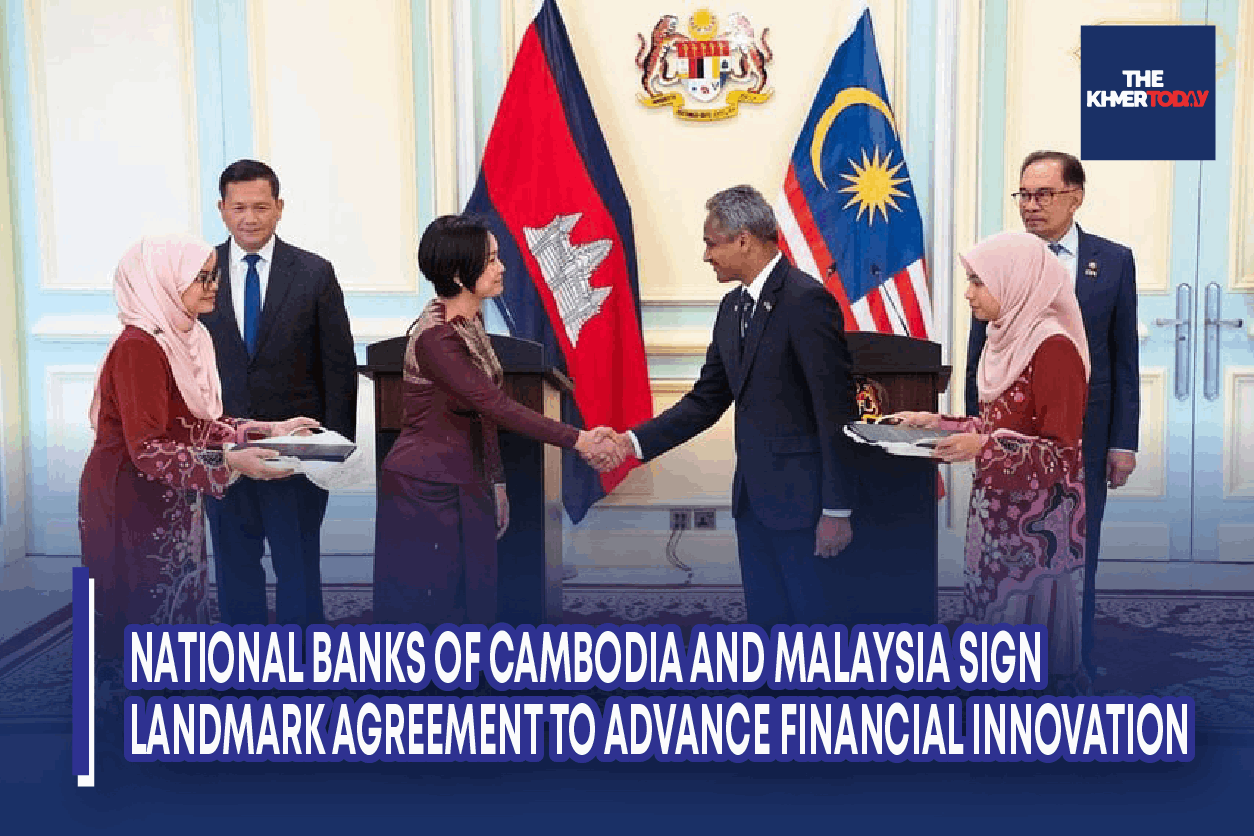

Governors Abdul Rasheed Ghaffour of BNM and Chea Serey of NBC ceremoniously exchanged this agreement in the presence of Prime Ministers Hun Manet of Cambodia and Yang Amat Berhormat Datuk Seri Anwar Ibrahim of Malaysia.

The MoU lays the groundwork for a cooperative initiative to accelerate financial innovation, with a specific emphasis on the creation of safer and more effective cross-border payment systems. As part of this plan, domestic payment systems will be integrated to enable cross-border QR code transactions. The goal is to create a joint supervision structure to guarantee the security of these international payments, strengthen the usage of local currency settlements, and expedite the payment process.

This partnership complements the G20 Roadmap to improve cross-border payment efficiency and adds a great deal to the ASEAN Regional Payment Connectivity framework. This innovation is expected to enhance international trade and tourism, benefiting up to 5 million merchants—including small companies from both nations who take QR payments.

Governor Ghaffour stressed the significance of the Memorandum of Understanding (MoU) in indicating the shared commitment to improving local currency settlements and cross-border payment capabilities, strengthening the nations' long-standing collaboration for the benefit of their respective business communities and citizens. He underlined how the deal will promote more financial integration and innovation, which will boost overall regional economic expansion.

Governor Serey echoed these remarks, stating that the day's events portend a critical improvement in coordination amongst the central banks. It is anticipated that the cooperation facilitated by the Memorandum of Understanding will spur commerce and financial inclusion between the two countries, promote financial innovation, and simplify cross-border QR payment systems. She emphasized how these initiatives are in line with ASEAN's goals.